| Washington, DC – March

2025 / NewsmakerAlert: U.S.

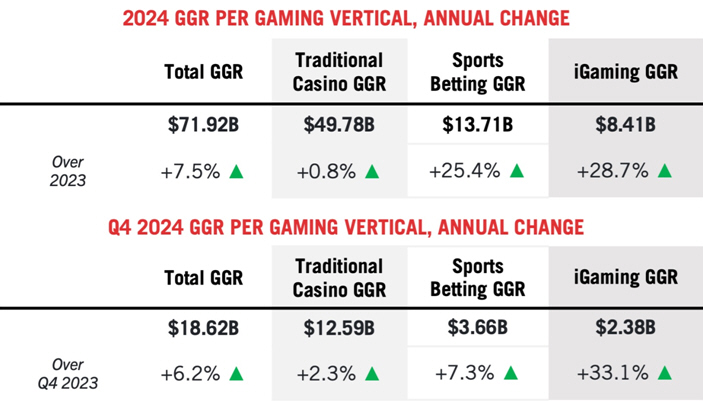

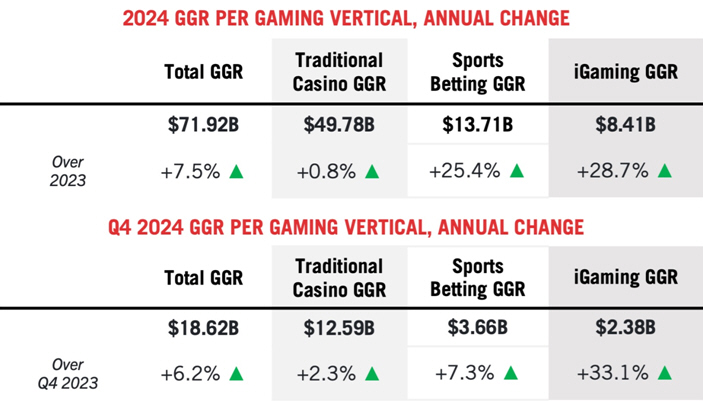

commercial gaming revenue reached an annual record of $71.92 billion in

2024, according to the American

Gaming Association (AGA) Commercial

Gaming Revenue Tracker. The total surpasses 2023’s previous high of

$66.5 billion by 7.5 percent, marking the industry’s fourth-straight record

revenue year.

The

year was punctuated by an all-time single quarter record revenue of $18.62

billion in Q4 2024.

|

|

|

“In

2024, Americans embraced the diverse legal gaming options available to

them—whether in casinos, at sportsbooks, or online—leading to another record-setting

year for our industry,” said AGA

President and CEO Bill Miller. “As we build on this success, the AGA

remains committed to fostering additional growth that benefits consumers,

operators, and communities alike.”

The

commercial gaming industry continues to evolve, with online gaming making

up 30.0% of nationwide commercial gaming revenue in 2024, generating a

new annual record of $21.54 billion. Looking at each sector:

-

Traditional

Gaming: Brick-and-mortar casino slots and table games generated a record

revenue of $49.78 billion in 2024, a growth of 82 basis points compared

to 2023. On a state level, 12 out of 27 traditional gaming markets achieved

new state revenue records this year.

-

Sports

Betting: In 2024, nationwide sports betting revenue reached $13.71

billion, a 25.4% increase from 2023’s record of 11.04 billion. In addition,

the fall sports calendar propelled legal sportsbooks to their most lucrative

quarter on record for the sixth year in a row, earning $3.66 billion, up

7.3 percent from the previous record set in Q4 of 2023. Both New Jersey

and Illinois exceeded $1 billion in annual sports betting revenue for the

first time.

-

iGaming:

2024 online casino revenue grew 28.7 percent year-over-year to $8.41 billion

in the seven states with full-scale legal iGaming. All six previously established

iGaming markets achieved new annual revenue records.

In 2024,

six of the top 20 commercial casino gaming markets reported revenue growth

compared to the previous year, with the Las Vegas Strip holding its spot

as the top market by commercial revenue. The next four top-performing markets—New

Jersey, Chicagoland, Baltimore, and Washington, D.C., respectively—all

similarly maintained their positions. This year, Queens/Yonkers entered

the top five, swapping placements with the Mississippi Gulf Coast.

The

commercial gaming industry also contributed more to state and local governments’

coffers than ever in 2024. Throughout the year, commercial gaming operators

paid an estimated $15.66 billion in gaming taxes, an increase of 8.5 percent

year-over-year. The industry also contributes billions of additional tax

dollars to states each year in the form of income, sales, payroll and various

other corporate taxes.

“The

sustained growth of legal gaming is a win for our industry and the consumers

and communities we serve,” said Miller. “Every dollar of gaming revenue

fuels jobs, investment, and economic growth—reinforcing why the legal industry’s

expansion is so important.”

About

American Gaming Association

As

the national trade group representing the U.S. casino industry, the American

Gaming Association (AGA) fosters a policy and business environment

where legal, regulated gaming thrives. The AGA’s diverse membership of

commercial and tribal casino operators, sports betting and iGaming companies,

gaming suppliers, and more lead the $329 billion industry and support 1.8

million jobs across the country. Visit www.AmericanGaming.org

for more information.

Via

Social Media: LinkedIn

|| X/Twitter || YouTube

Media

Contact

Dara

Cohen

Senior

Director,

Strategic

Communications & Media Relations

202-552-2675

LinkedIn |