Back To News/PR Index

|

|

|

| Alexandria, VA – May

2022 / Newsmaker Alert: There

are 148,026 conveinence stores

in the United States, of which 116,641 of those stores sell fuel. That

number has decreased over the years as demand has plateaued and drivers

seek out modern stations with more fueling spots and/or a robust in-store

offer.

There are four broad categories of fueling locations:

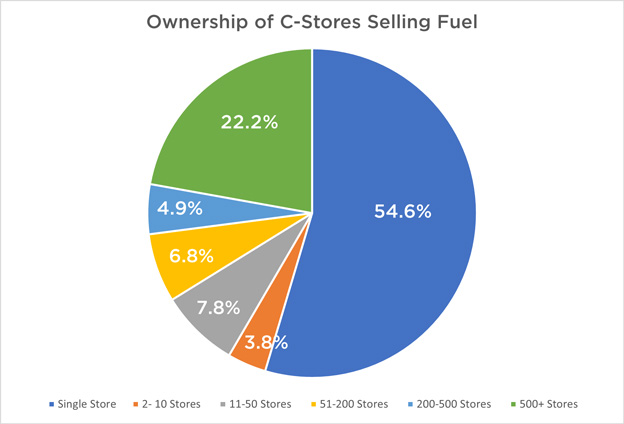

Small Businesses Fuel America For decades, convenience stores have sold the most gas in the United States; however, that was not always the case. In 1971, just 7% of convenience stores sold fuel. The move toward self-fueling to save a few cents, spurred by the price shocks of the 1970s, led to more consumers embracing convenience stores for lower prices on gas and one-stop shopping for additional in-store items. By the mid-1980s, convenience stores sold most of the gas in the country. Today,

there are 116,641 convenience stores selling fuel in the United States.

Overall, 55% of these locations are single-store operators. Many of these

operations may not have the resources to brand their stores separately

from the brand of fuel they sell and promote on the canopy, often leading

to misperceptions that their business is owned and operated by a major

oil company. (Source: NACS/NielsenIQ

2022 Convenience Industry Store Count)

Major oil companies have begun to reemerge on the retail landscape, reversing a decade-plus trend that reduced their share of the market to less than 0.5% by 2017. Shell Oil Co./Motiva Enterprises LLC, Chevron Corp., Exxon Mobil Corp., BP North America and ConocoPhillips/Phillips 66 collectively have approximately 15,400 stores that all are franchise operations. Shell Oil Co./Motiva Enterprises LLC and Chevron own and operate stores. The remaining 50% of convenience stores selling fuel have established their own fuel brand and purchase fuels on the open market or via unbranded contracts with a refiner/distributor. The Decline in Fueling Sites There are fewer fueling locations in the United States than 10 years, and significantly fewer than 30 years ago—or even 60 years ago. Some estimates suggest there were 300,000 fueling outlets in the 1920s—twice the number of outlets that there are today—that sold small volumes. The last comprehensive census of fueling sites was conducted in 2012 by National Petroleum News (NPN), a publication founded in 1909 to track and analyze the petroleum industry. The last published station count in 2012 identified 156,065 locations, a sharp drop from the 1991 count of 210,120 fueling locations. Prior to 1991, NPN published a store count based on U.S. Census data that included gas stations that derived more than 50% of their earnings from petroleum products and services (traditional gas stations) and did not include convenience stores, garages, repair shops, dealerships and independent operators. This count was dramatically lower than previous counts, and it’s possible that 100,00 or more fueling locations were omitted from this census. NPN showed a decline in fueling locations from 114,748 in 1987 to 111,657 in 1990. From the mid to late 1980s, the fueling count also dropped, but was based on a different accounting. During this period, the U.S. Census count was limited to stores with payrolls, eliminating small independent stations without payrolls (roughly 15% of the industry). This count also only included gas stations that derived more than 50% of their earnings from petroleum products and services and did not include convenience stores, garages, repair shops, dealerships and independent operators. With this limited data set, the defined number of fueling locations dropped from 116,154 in 1984 to 93,864 in 1987. It’s possible that 120,000 or more fueling locations were omitted from this count annually. The steepest drop in fueling location count was from 1970 to 1985 and used U.S. Census data. During this period, very few outlets besides service stations sold fuel, so the count is a more accurate representation of the total fueling universe but underreports the overall fueling universe. During that 15-year period, the number of fueling locations dropped by almost 100,000, from 222,000 in 1970 to 130,000 in 1985. Prior to 1970, annual station counts are spottier but over 200,000: 211,473 in 1963 and 206,755 in 1958. About

NACS

NACS

Contact:

|