Back

To News/PR Index

||

|

Santa

Clara, CA – December 2024 / NewsmakerAlert: Rents

declined in November, falling by -1.1% year over year to a median of $1,703,

according to the Realtor.com®

November Rental Report released Monday (December 16). Despite the dip

in rents, affordability remains a concern, with minimum wage earners requiring

extended working hours to afford a typical rental unit in 44 of the top

50 metros in the United States.

“Lower

rents, combined with stable or increased minimum wages, have offered a

break to renters in some metro areas this year, though many minimum wage

earners still struggle to find affordable rents,” said Danielle

Hale, chief economist at Realtor.com®.

“With minimum wages set to increase in more than half of the top 50 markets

next year, and a projected

0.1% annual decline in median asking rents in 2025, we expect some

further relief in the coming year; however, more new construction is still

one of the biggest levers we have to help with affordability.”

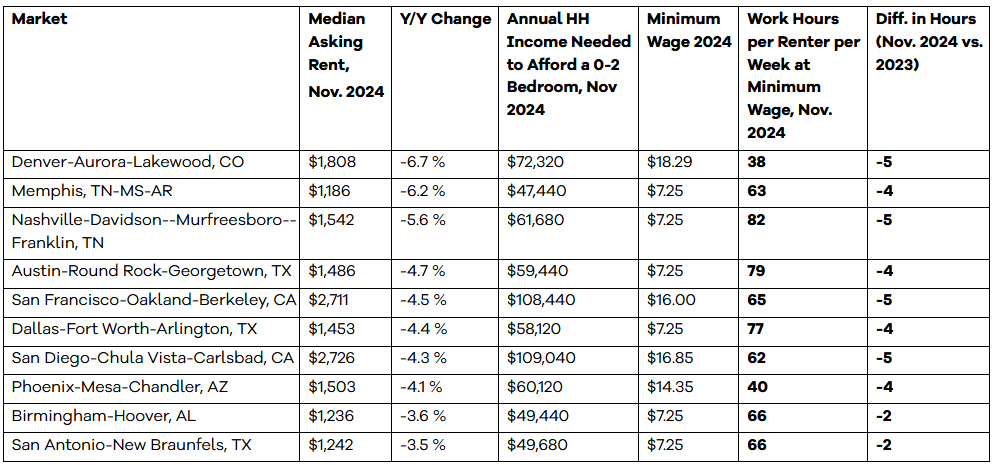

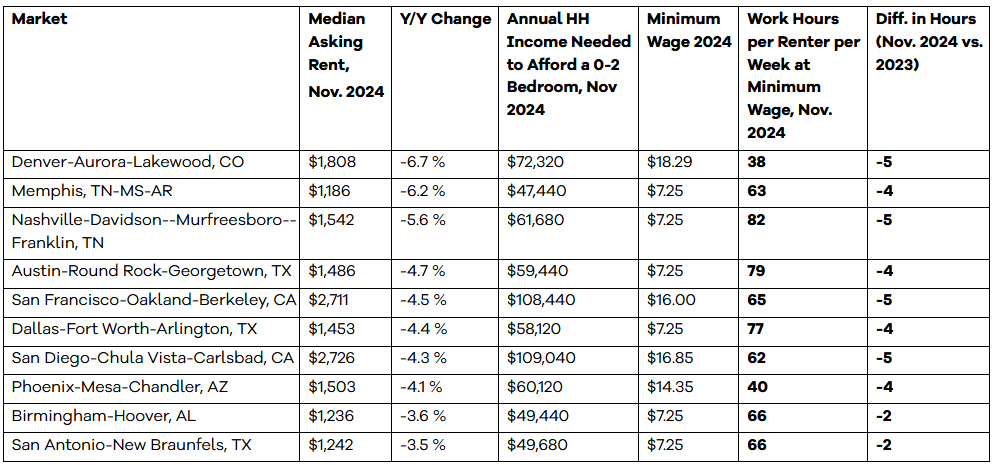

To

better understand the hurdles faced by hourly workers in today’s rental

market, this month, Realtor.com® analyzed how many hours per week a

renter would need to work at local minimum wage rates to afford a typical

0-2 bedroom home. Among the top 10 markets with the largest year-over-year

rent declines in November, fewer working hours were required to afford

the median rent compared to the same time last year. Yet only in Denver

and Phoenix could two minimum wage earners each work 40 hours or less per

week and affordably split the median rent for a 0-2 bedroom unit.

|

|

Minimum

wage earners need to work extended hours to afford rents

To

keep their half of the rent at an affordable 30% of their budgets, two

minimum wage earners would have to each work 82 hours per week in Nashville,

Tenn., 79 hours in Austin,Texas and 77 hours in Dallas, despite large year-over-year

rent declines. The affordability crunch is worst in markets that are subject

to the federal minimum wage of $7.25 per hour. But in San Francisco, where

the minimum wage is $16, and San Diego, where it’s $16.85, workers would

still need to work 65 and 62 hours per week respectively to afford the

median rent. By contrast, in Denver and Phoenix, two minimum wage earners

would each need to work 38 and 40 hours per week respectively to afford

the median rent.

Higher

minimum wages and falling rents point to continued relief in 2025

Minimum

wages will rise in 23 of the top 50 markets on Jan. 1, 2025, while additional

markets will see increases later in 2025. If rents hold steady, eight of

those markets are expected to see at least a two-hour reduction in weekly

working hours at minimum wage needed to afford rent. In both St. Louis

and Kansas City, Mo., where the minimum wage is due to rise to $13.75 per

hour from $12.30, two workers earning that wage will each need to work

four hours less per week to afford the median rent. Minimum wage earners

will need to work two hours less in six markets: Sacramento, Calif., Virginia

Beach, Va., Riverside, Calif., San Francisco, New York, and San Jose, Calif.

Release

continues

here...

Media

Contact:

Greg

Taylor

SVP

Marketing

LinkedIn |